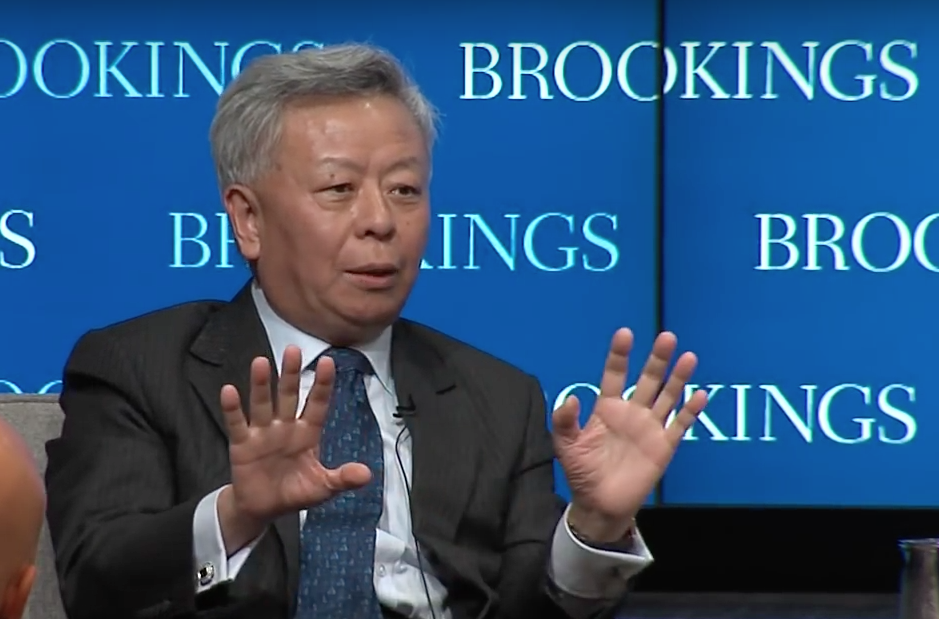

The world of development finance is shifting. At the same time that the ultimate legacy multilateral development bank, the World Bank, undergoes a complete transformation of its Environmental and Social Safeguards Framework, a new behemoth is coming online and is quickly preparing to launch: the Asian Infrastructure Investment Bank (AIIB). With 57 founding member countries led by China, the AIIB forecasts that its first batch of investments will be ready by the second quarter of 2016. On October 21, AIIB president-designate Jin Liqun spoke at the Brookings Institute and answered questions about the new bank. Amidst environmental, social, and political fears, the AIIB trumpets its intention to be a “lean, clean, and green” institution with a 21st century governance model.

According to Liqun, the purpose of the Asian Infrastructure Investment Bank is simple: “to promote broad-based economic and social development through infrastructure investment in Asia.” He assures that China has not forgotten the roles the World Bank and the Asian Development Bank played in helping China lift 500 million citizens out of poverty. Liqun stated that it is now China’s turn to return the favor and contribute to the development of the rest of the Asian continent.

From his opening remarks it was clear that Liqun was aware of the apprehension surrounding the AIIB, and most of his speech seemed directed at assuaging fears that the AIIB would have little regard for human rights or the environment and push out other multilateral development banks. Liqun reminded the audience that the Bretton Woods system was established 70 years ago, and the Asian Development Bank is celebrating its 50th birthday next year, signaling the need for new international finance institutions to enter the game. He described the AIIB not as a rival but as a “sibling” to the other banks, and emphasized that the legacy banks were involved in the development of the AIIB and will even be co-financiers in its first batch of projects.

Despite Liqun’s candor about the public’s concerns, his remarks did little to address the serious criticisms raised over the AIIB’s draft Environmental and Social Safeguard Framework. The AIIB released the document on September 7 and initially only accepted written consultations until October 6. That deadline was later extended by a few weeks. The staggeringly short consultation drew numerous complaints from civil society groups worldwide. The AIIB also did not organize any face-to-face consultations, relying exclusively on written submissions and video conferences. On October 26, eleven experts from the UN Human Rights Council submitted comments on the safeguards, calling for stronger language and more explicit references to specific human rights, such as housing and access to sanitation and energy. The comments also pointed out that AIIB member states are bound by international laws, treaties, and conventions – standards that must be incorporated in the safeguards, including the International Labour Organisation Declaration on Fundamental Principles and Rights at Work, the UN Declaration on the Rights of Indigenous People, and the International Covenant on Economic, Social, and Cultural Rights.

As the event concluded, a representative from the Center for American Progress finally raised the point that the draft Environmental & Social standards leave room for investments in projects with negative environmental impacts, such as coal power plants. Liqun’s response demonstrated the complexity of the issue. Though in principle the AIIB is committed to reducing greenhouse gas emissions, he echoed the World Bank’s position that it would not tell an impoverished country with access to coal (and lacking access to affordable alternative energy sources) that they cannot build a power plant. This either/or option for rural electrification is a false choice; funding from the AIIB should provide a path to sustainable development that does not shackle poor communities to the dirtiest energy for the long-term. For now, the board will likely make decisions on coal power on a case-by-case basis.

As the AIIB finalizes its environmental and social policies and launches its first set of projects next year, the world will be watching to see if the bank truly follows through with its commitment to be a 21st century institution working toward actual sustainable development.

Read: joint submission from civil society on accountability in the AIIB

Watch: full event