Homeowners risk billions in losses as ‘Dirty Dozen’ insurers—citing climate risks— pull coverage while profiting from fossil fuels

Published April 3, 2024

By Risalat Khan, Senior Strategist, Insure Our Future campaign, and Charles Slidders, Senior Attorney, Financial Strategies at the Center for International Environmental Law.

California homeowners face a potentially staggering economic blow due to climate-related insurance non-renewals. Insure Our Future’s analysis finds homeowners could lose between $9.87-32.1 billion in property value as a result of more than 100,000 non-renewals. Twelve major insurers have restricted homeowners insurance in California, often citing climate risks as a major factor. Dubbed the ‘Dirty Dozen’, these insurers collectively have an estimated $113 billion of investments in and $3.6 billion of underwriting income from fossil fuels, the very driver of the climate risks that have, in large part, pushed California’s home insurance market to its limits.

The ‘Dirty Dozen’ Insurers Fueling the Fire

Three companies recently announced mass non-renewal decisions: Berkshire Hathaway (50,000 by AmGUARD), State Farm (30,000 home insurance policies out of 72,000), and Nationwide (20,275 by Crestbrook). The estimate of economic loss as a result of these non-renewals is likely to represent an undercount. Nine other insurers — AllState, American International Group (AIG), Chubb, Farmers (owned by Zurich), Liberty Mutual, The Hartford, Travelers, Tokio Marine, and USAA — have reportedly restricted climate-related risk coverage in California as well, which also adversely impacts homeowners.

All twelve companies are, and have long been, major supporters of fossil fuels despite the mounting severity of warnings from actuaries, climate scientists, and impacted communities. While they have justified their decisions in California by highlighting the state’s unique regulatory environment, several of them are also shrinking coverage for climate-related risks across the nation while continuing to exacerbate those risks. The Senate Budget Committee is actively investigating these practices.

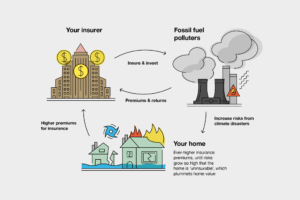

The Vicious Cycle of Uninsurability

This alarming trend underscores a vicious cycle: homeowners, already burdened by escalating premiums driven to a large extent by unchecked greenhouse gas emissions, now find themselves dropped by their insurers. Meanwhile, these insurers continue to profit from fossil fuel expansion, further exacerbating climate risks.

In the months preceding the Global Sustainable Insurance Summit — to be held on April 9-10 in Los Angeles — California homeowners are struggling to afford insurance coverage and facing associated impacts on property value. Taken together, the insurers’ business decisions, which are often justified using climate change, exacerbate the cost of living crisis faced by California households. The same companies continue to profit from underwriting and investing in fossil fuel projects that are making climate risks worse for the next insurance renewal cycle, when they would make the decision again whether to drop certain policyholders for being too risky to insure. This vicious cycle of uninsurability is not limited to California, and its engine is greenhouse gas emissions.

Communities across the country and the world are shouldering the rapidly increasing costs of the climate emergency. The most vulnerable, and the ones least responsible for causing the climate crisis, face some of the steepest burdens – an already dire and escalating environmental injustice. Legislators and regulators must rebalance the scales and make the companies most responsible for driving the climate crisis pay for skyrocketing climate-related costs.

Proposals about stabilizing California’s insurance market that fail to calculate and rectify the transfer of financial resources from families to polluters would only serve to continue the de facto carbon tax that families are paying as part of their premiums every month. Rather than taxing families to subsidize corporate profits, major carbon polluters and their enablers should instead be paying the costs of the escalating climate crisis.

State Authorities Can Make Polluters Pay

In March, in ‘the insurance capital of the world’, Connecticut lawmakers took the significant step of advancing a novel surcharge mechanism on fossil fuel insurance policies written within the state, in order to raise funds for climate resiliency efforts. If Governor Ned Lamont of Connecticut passes the Climate Resiliency bill (SB 11) with this provision intact, he would show other states a possible path for shifting the cost burden away from households to polluters—a core principle of climate resiliency as costs mount unsustainably.

If states are the laboratory for innovative legislative and regulatory approaches, lawmakers and insurance commissioners should urgently consider how to use the freedoms granted to them by the McCarran-Ferguson Act to shift the climate costs imposed in insurance premiums away from vulnerable constituents, and toward those still fanning the flames of the climate emergency. People paying the carbon tax in their premiums (‘pollution premiums’) and losing their home value, and organizations advocating for them, should demand nothing less of their state representatives.

Insurers are subject to consumer protection laws, including the Unfair Competition Law (UCL) in California, which bars unfair conduct such as acts deemed unconscionable. Insurers are exacerbating climate risk through their investments in and/or underwriting of fossil fuel activities that are incontrovertibly the primary driver of climate change, profiting from that heightened risk through premium hikes, and then refusing to renew policies for areas increasingly exposed to climate-fueled disasters—resulting in further economic losses to dropped policyholders.

According to the Center for International Environmental Law, this may constitute unconscionable conduct under the UCL, and/or a violation of the state’s implied covenant of good-faith dealing in contracts, and be subject to enforcement action by the Attorney General, as well as potential private claims, and possible civil penalties.

Act Before It’s Too Late

2023 was the hottest year on record, marked by climate disasters of unprecedented scale and mass suffering, and yet it could be one of the coolest years for the rest of this century. A team of climate scientists and actuaries warned last month about the planetary-scale ‘risk of ruin’ and insolvency if we cross tipping points in the Earth system that we are already at risk of having set in motion by exceeding 1.5°C of ‘committed’ global heating.

The climate crisis is rapidly destroying the foundations of a healthy planet for youth and future generations. The insurance industry is in a powerful position to avert such a future by accelerating the transition from fossil fuels to a clean energy economy and keeping humanity from hitting the limits of adaptation and resilience. Before the window to limit warming to 1.5°C closes, the Global Sustainable Insurance Summit presents the insurance industry with the opportunity to act decisively—stop enabling fossil fuel expansion, rapidly decarbonize and align with a credible 1.5°C pathway, respect human rights, and explore legal pathways to recover costs from fossil fuel polluters instead of families. Later is too late.

Appendix: Estimation of Lost Property Value for California Homeowners.

This analysis is also posted on Insure Our Future website here.